Multimedia content

- Images (2)

- Access to Capital Markets for African Cities and Subnational Governments: Capacity-Building Program to Foster Economic and Financial Development of African Cities

- Access to Capital Markets for African Cities and Subnational Governments: Capacity-Building Program to Foster Economic and Financial Development of African Cities (FR)

- Documents (2)

- Access to Capital Markets for African Cities and Subnational Governments: Capacity-Building Program to Foster Economic and Financial Development of African Cities (1)

- Access to Capital Markets for African Cities and Subnational Governments: Capacity-Building Program to Foster Economic and Financial Development of African Cities (2)

- All (4)

Access to Capital Markets for African Cities and Subnational Governments: Capacity-Building Program to Foster Economic and Financial Development of African Cities

The upcoming training in Johannesburg will specifically focus on the practical experiences of South African municipalities in accessing the capital market

The objective of this program is to prepare African cities and territories, who are members of ATIA, for accessing finance

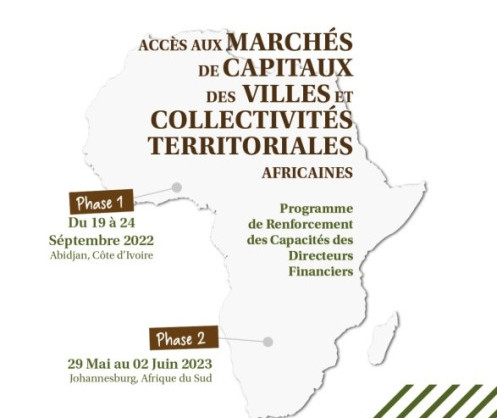

United Cities and Local Government of Africa (UCLG Africa) (https://www.UCLGA.org/), in partnership with the African Development Bank (AfDB), is organizing the second phase of its capacity-building program for Chief Financial Officers of African cities. This training will be held in Johannesburg from May 29th to June 2nd, 2023, as part of the implementation of the Africa Territorial Trade and Investment Agency (ATIA). ATIA serves as a financial vehicle aimed at enhancing the investment capacity of African cities and subnational governments through bond issuance in the financial market.

Download Document 1: https://apo-opa.info/428K3uA

Download Document 2: https://apo-opa.info/45vHWnj

The objective of this program is to prepare African cities and territories, who are members of ATIA, for accessing finance. The first training was conducted in Abidjan, Côte d'Ivoire, from September 19th to 24th, 2022, with financial support from GiZ and the Sahel and West Africa Club of the OECD. During the training, participants received guidance from experts representing various organizations including the Regional Council for Public Savings and Financial Markets (CREPMF), Bourse Régionale des Valeurs Mobilières d'Abidjan (BRVM), Bloomfield Investment Rating Agency, HUDSON Intermediation and Management Company, the West African Development Bank (BOAD), the African Development Bank (AfDB), and United Cities and Local Governments of Africa.

The upcoming training in Johannesburg will specifically focus on the practical experiences of South African municipalities in accessing the capital market. It will receive support from C40, an organization dedicated to combating climate change and representing 94 of the world's largest cities, as well as the Development Bank of Southern Africa (DBSA), the European Investment Bank (EIB), the Urban Municipal Development Fund (UMDF), and the South African National Treasury.

This capacity-building program for Chief Financial Officers of African cities and territories aims to equip participants with the necessary knowledge, skills, and tools to successfully access the financial market, enhance their investment capacity, and support the economic development of African cities and subnational governments. Furthermore, it highlights the commitment of UCLG Africa, the African Development Bank, and all partners to supporting financial initiatives, empowering African cities and territories, and fostering their economic growth.

The media and press organizations are cordially invited to cover the press briefing that will be organized after the opening of the training at the Hilton Sandton Hotel in Sandown, Johannesburg, South Africa.

The Communication Department of UCLG Africa is also willing to organize and facilitate appointments with experts and participants of the training, provided that interested media and press organizations submit their request to the department before the event.

Distributed by APO Group on behalf of United Cities and Local Governments of Africa (UCLG Africa).

For media and press inquiries please contact:

Wafae Boumaaz

Tel +212 660128943

Email: wboumaaz@uclga.org

About Africa Territorial Trade and Investment Agency (ATIA):

The Africa Territorial Trade and Investment Agency (ATIA) is an initiative of UCLG Africa that directly contributes to the implementation of the provisions of the Addis Ababa Action Agenda (AAAA) regarding the access of African cities and subnational governments to the financial market. ATIA distinguishes itself with its shareholder agreement that recognizes the primacy of cooperative society members in its governance, ensuring close control by African cities and subnational governments. However, ATIA will operate in accordance with strict banking requirements to prevent any political interference in its operations.

About African Development Bank:

The African Development Bank (AfDB) (www.AfDB.org) is a multinational bank founded on August 4th, 1963, during the Khartoum Conference. This agreement came into force on September 10th, 1964, in Khartoum, Sudan. However, it was only from July 1st, 1966, that the Bank launched its activities. Its primary role is to contribute to social progress and the economic and individual or collective development of member countries in the region. To achieve this, the AfDB Group mobilizes resources to promote investments in sectors such as the private sector, agriculture, health, education, infrastructure, and more.

The AfDB has 54 regional African member countries and 26 non-regional African member countries. Additionally, the AfDB Group includes other institutions such as the African Development Fund (ADF) and the Nigerian Trust Fund (NTF). It plays a crucial role in developing financial markets in Africa. In this regard, the AfDB collaborates with various initiatives and partnerships, including the Making Finance Work for Africa initiative launched in 2007 by the G8 group and the African Financial Markets Initiative (AFMI) established in 2008 to develop local currency bond markets in Africa. Well-established and liquid bond markets are vital for sustainable development driven by market-based capital allocation. However, bond markets in Africa are still largely underdeveloped, with corporate bond markets being non-existent or in their early stages.

About United Cities and Local Governments of Africa (UCLG Africa):

United Cities and Local Governments of Africa (UCLG Africa) (https://www.UCLGA.org/) is the umbrella organization for local government entities in Africa. It was founded in 2005 in the city of Tshwane, South Africa, through the consolidation of three continental groups of local governments: the African Union of Local Authorities (AULA), the Union of African Cities (UVA), and the African section of the União das Cidades e Capitais Lusófonas (UCCLA).UCLG Africa brings together 51 national associations of local and regional governments from all regions of Africa, as well as 2,000 cities and territories with populations over 100,000. UCLG Africa represents over 350 million African citizens.As a founding member of the global organization UCLG, UCLG Africa serves as the regional section for Africa. Its headquarters are located in Rabat, the capital of the Kingdom of Morocco, where it enjoys diplomatic status as a Pan-African International Organization. UCLG Africa also has five regional offices in Cairo, Egypt (for North Africa); Accra, Ghana (for West Africa); Libreville, Gabon (for Central Africa); Nairobi, Kenya (for East Africa); and Pretoria, South Africa (for Southern Africa).